Mr. Caprio has been involved in asset acquisition, finance and managament for more than 25 years. His experience includes various leadership roles in both public and private enterprises.

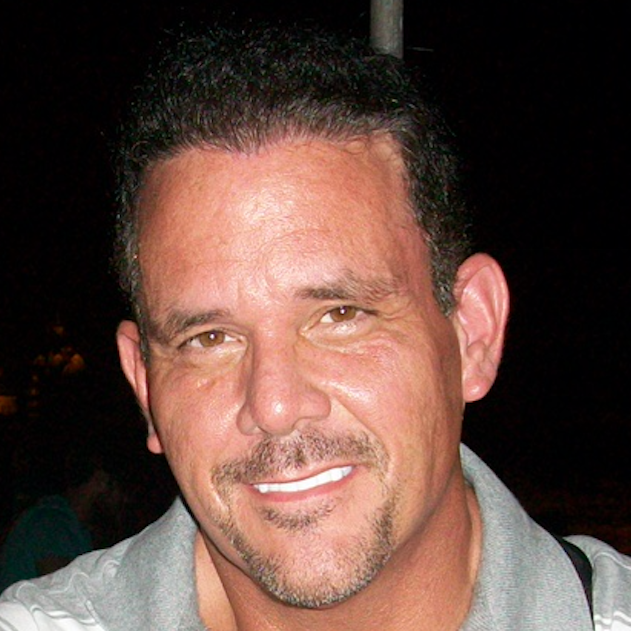

Mr. Statlander is the Marketing and Leasing Managing Director with over 16 years of experience in investing, selling, developing and managing real estate.

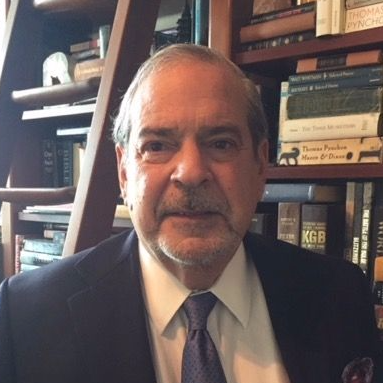

Mr. Ulloa is the Senior Managing Director and Principal of Omicrom Development, LLC – Real Estate Equity and Structured Finance Group.

Our Analysis team consists of Real Estate Industry Professionals with over twenty years of experience evaluating commercial real estate, leases and rent rolls.

Acquisitions team identifies attractive risk-adjusted investment opportunities in office, multifamily, industrial, retail, hotel, and specialized real estate, such as senior housing and self-storage.

Our management team takes a very hands on approach with each asset we acquire. We focus on operations, rent growth, lease-up and expense controls with a strong emphasis on in-place cash flows.

Market cycle analysis enhances our investment-decisions. Omicrom actively monitors both macro and specific commercial real estate markets and the lagged relationship between demand and supply for physical space. Long-term occupancy average for the specific market and property type are key factors in the overall acquisition decision making process.

At a macro level, Omicrom assesses broad geopolitical and economic events that can derail a potential investment. At the micro level, debt risk, cap rate risk, tenant risk, leasing risk, physical asset risk, entitlement risk (new development only, construction risk, market risk and geographic risk are all thoroughly examined. Omicrom peels back the different layers of risk to determine if the assets meets our superior risk-adjusted return standards.

Once a determination of risk level is identified in an investment opportunity, the analysis team proceeds with a rational assessment of the asset valuation which include Sales Comparison Approach, Capital Asset Pricing Model, Income Approach and Cost Approach to formulate a bottom line valuation asessment that is a compilation of components from all of these valuation methods.

Finally, a specific exit strategy is crafted for the potential acquisition. The exit stratgy will include the acquisition type (add value, reposition, income, etc.), intended use, holding period, anticipated 1, 2, 3 year proformas and anticipated liquidation projections.